There are a lot of forms involved in filing taxes, so make sure you have everything you need before preparing your tax returns in California:

- Gather any documents related to income earned throughout 2024.

- Gather forms supporting available deductions or tax credits related to healthcare, childcare, education, and job expenses.

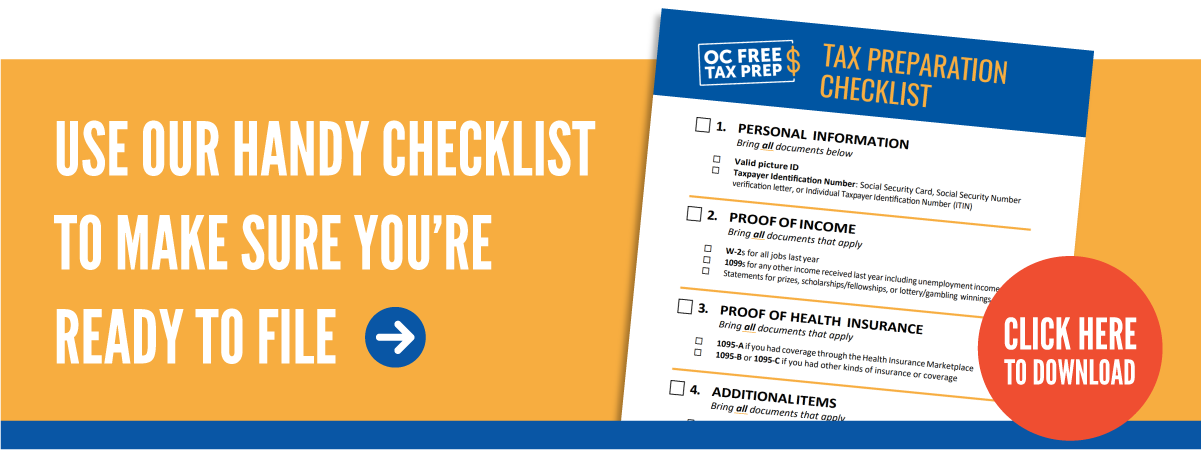

It is never too early to start gathering your tax documents! You can download our handy checklist to make sure you’re fully prepared to file. The documents can be used for both your federal and California state return.

It is never too early to start gathering your tax documents! The documents can be used for both your federal and California state return.

Personal Documents

- Your social security number or Individual Taxpayer Identification Number (ITIN), as well as those of anyone you may be claiming on your tax return, including your spouse if you are filing jointly.

- Photo identification.

Income Documents

- W-2 forms from any employers you worked for in 2024.

- 1099 forms for any contract work you completed if you earned more than $600 total.

- Income from unemployment or social security benefits.

- Income from the previous year’s state and local tax returns.

- Income from any rental properties you may own.

Income Adjustment, Credit, and Deduction Documents

- Receipts from charitable donations.

- Receipts from moving expenses for active military.

- Receipts from job search expenses.

- Records related to loss of property or insurance claims from a federally declared disaster.

- Bank account and routing number if you want your refund direct deposited.

Other Documents

- Contributions to a Medical Savings Account (MSA).

- Contributions to an IRA.

- Interest from investments, stocks, or other property.

- Costs related to childcare (including the provider’s tax ID number) or adoption.

- Costs related to education (1098-T and 1098-E).

- Costs related to homeownership (1098s for mortgage interest, property tax, energy-saving improvements, or other expenses).

- Costs related to medical care from doctors, hospitals, or other providers.

- Form 1095-A for health insurance through the Marketplace Exchange, or 1095-B or -C for health insurance through another source.

Get Help Filing Your Return

If the thought of preparing and filing your taxes makes your head spin, have no fear – there is help available through OC FREE TAX PREP. Orange County United Way has joined forces with the IRS, and a coalition of local partners to support Orange County residents during tax season. This year, OC Free Tax Prep will continue to provide its free tax preparation service with in-person and online options:

- File with an expert at an in-person OC Free Tax Prep location

- File your own taxes online at MyFreeTaxes

You can now get money-saving tax tips from Orange County United Way’s OC Free Tax Prep sent directly to your mobile device by texting MONEYBACK to 50503 and all for free! Learn more about the program here.

With tax season upon us once more, Orange County residents are seeking ways to get their returns completed efficiently while also keeping as much of their hard-earned money as they can. OC Free Tax Prep is here to help. Starting now, you can get some amazing money-saving tax tips simply by sending us a text message!

Here’s all you have to do: text MONEYBACK to 50503 today. That’s all there is to it! From there, we’ll send you helpful tax tips, reminders about key deadlines, and links to some other free resources from OC Free Tax Prep.

Brought to you by the Orange County United Way, OC Free Tax Prep can help you:

Here’s all you have to do: text MONEYBACK to 50503 today. That’s all there is to it! From there, we’ll send you helpful tax tips, reminders about key deadlines, and links to some other free resources from OC Free Tax Prep.

Brought to you by the Orange County United Way, OC Free Tax Prep can help you:

Here’s all you have to do: text MONEYBACK to 50503 today. That’s all there is to it! From there, we’ll send you helpful tax tips, reminders about key deadlines, and links to some other free resources from OC Free Tax Prep.

Brought to you by the Orange County United Way, OC Free Tax Prep can help you:

Here’s all you have to do: text MONEYBACK to 50503 today. That’s all there is to it! From there, we’ll send you helpful tax tips, reminders about key deadlines, and links to some other free resources from OC Free Tax Prep.

Brought to you by the Orange County United Way, OC Free Tax Prep can help you:

- File your taxes for FREE! In-person assistance is available at various locations throughout Orange County.

- Learn more about programs like EITC, which can put more money in your pocket!

- Ensure that you’re not leaving money on the table or paying more than you need to.